Magellan's Portfolio Manager, Alan Pullen shares his case for concentrated strategies and how he identifies stocks that make their way into his portfolios.

Magellan's Portfolio Manager, Alan Pullen sits down with livewire to provide his analysis on three global growth stocks and names a company he believes has been undervalued by the market.

The Attribution Managed Investment Trust, also known as the AMIT regime, is a taxation system for eligible managed funds. All Magellan and Airlie funds have elected to be an AMIT.

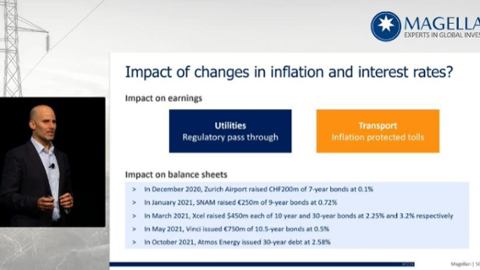

In this Views from the Top, Stack outlines the impact of real rates and oil prices on infrastructure returns, shares which types of companies the team typically gravitates to and those they avoid, and shares whether Aussie investors are likely to see continued M&A activity in the space over the coming through months.

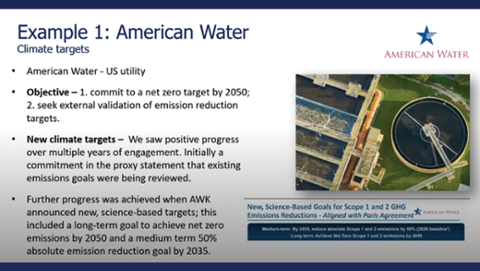

Amy Krizanovic discusses the evolution of Magellan’s approach to climate and metrics, guided and supported by investor groups and responsible investment organisations.

RIAA's Artificial Intelligence and Human Rights Investor Toolkit seeks to enhance the investment community's understanding of the financial and human rights risks associated with AI.

Amy Krizanovic, Head of ESG, spoke on the panel at the Responsible Investment Association Australia conference, discussing the Artificial Intelligence and Human Rights toolkit, an essential resource to navigate this critical intersection. (Viewing time: 45 mins)

Members of our investment team dissect the markets and take a deeper look into the sectors and stocks that make up our global portfolio. This series is designed to provide you with concise, relevant and digestible talking points on global markets, each approximately 10 minutes.

Cognitive biases are ‘hard wired’, and we are all liable to take shortcuts, oversimplify complex decisions and be overconfident in our decision-making process. (Reading time: 6 mins)

A long-term investment typically means that an investor will hold an investment, such as securities, bonds or exchange-traded funds for at least five years or more on average. Whilst there is no firm time frame of what is considered long-term investing, it requires continuous investment, regardless of market volatility and fluctuating price levels of assets.

Investing in infrastructure is about investing in the companies that provide essential services to society and that generate predictable long-term earnings.

Dividends and distributions play an important role in the world of investing, offering the potential for investors to receive a stable and reliable income stream.

Webinar Recording: Investment Analyst, Tracey Wahlberg, provides insight into key growth opportunities shaping the consumer sector's future returns..

Opportunities found in troubled waters. (Reading time: 8 mins)

Ben McVicar and Ofer Karliner take us through the impact of cost-of-living pressures on toll roads and what holdings they are most excited about in the portfolio. They provide an update on passenger travel and airport spending rates as well as insights on the US election and how this could affect energy transition efforts. (Viewing time: 12 mins)

Nikki Thomas and Arvid Streimann discuss key themes impacting the markets and providing opportunities for investors. Arvid discusses his recent trip to Washington which provided valuable insights into the future growth of AI innovation and adoption. Nikki touches on her future trip to China and how understanding the interplay between China and other economies is essential for businesses operating within China or competing against it in various sectors. (Viewing time: 12 mins)

The way to analyse Infrastructure assets and the businesses that own them.

Our Global Equities and Infrastructure Portfolio Managers share their views on key global themes driving investment markets. Discussing the implications of interest rates, continued supply chain disruptions, digitalisation, AI and why Global Equities and Infrastructure investors have cause for optimism. (Viewing time: 91 mins)

Elisa Di Marco sits down with Investment markets and provides insights into how Magellan constructs their global portfolios. (Viewing time: 16 mins)

Identifying quality goes hand in hand with identifying risk. (Reading time: 4 mins)

Webinar Recording: Investment Analyst, Adrian Lu, provides insight into the evolving landscape of Artificial Intelligence (AI).

While we have a high conviction in the structural tailwinds of AI we must also understand the risks associated with this expansive technology. (Reading time: 5 mins)

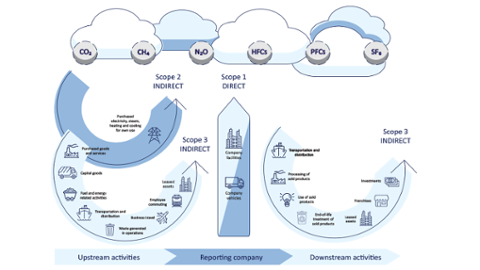

The majority of Greenhouse Gas (GHG) emissions released into the atmosphere can be attributed to human activities. These emissions usually come from power generation, industrial processes and cars. GHG emissions can be classified into three categories: scope 1, scope 2, and scope 3 emissions.

Arvid Streimann discusses investment attributes that led the market in 2023 and key thematics to watch out for in the year ahead, while Nikki Thomas shares her insight on how the portfolio is positioned and the strategy behind investment decisions in the portfolio. (Viewing time: 12 mins)

Gerald Stack discusses the impact of interest rates on the infrastructure sector and how this affects company valuations. Gerald also provides insight on movements within the infrastructure strategy and how the team are positioning the portfolio for 2024. (Viewing time: 12 mins)

Regulated utilities are known for their ability to generate predictable returns regardless of market conditions. For this reason, we often describe utility stocks as the ‘lead in the keel’ of our infrastructure portfolios. They allow us to navigate volatile global equity markets with confidence.

Ben McVicar, CFA, Portfolio Manager, speaks with Jacinta King, ASX, about the Magellan Infrastructure Fund (ASX:MICH), the impact of higher interest rates on infrastructure assets and how their definition of infrastructure informs their investment decisions. (Listening time: 15 mins)

Magellan’s Portfolio Managers, Alan Pullen and Elisa Di Marco sit down with Hearts & Minds CIO, Charlie Lanchester. They discuss Magellan’s approach to high conviction investing, how they select top stocks for the HM1 portfolio, and how they avoid short-term noise. (Listening time: 37 mins)

In this episode, Caroline Gurney, CEO of Future Generation, speaks to Nikki Thomas, Portfolio Manager of Magellan Financial Group’s Global Fund. With more than 20 years’ experience in markets, Nikki is recognised for her work in bringing global equities to Australia and prides herself on investing in the world’s best global stocks. In this episode, Nikki shares insights on the recent US reporting season, her market outlook, and optimism about the US market. (Listening time: 29 mins)

Infrastructure asset prices have been under some pressure this year with high interest rates and other headwinds. Ben McVicar discusses recent relative performance, why it has been challenging and how the team are positioning the portfolio going forward. (Viewing time: 14 mins)

Arvid Streimann discusses recent market volatility and the risks to watch out for, while Nikki Thomas shares her observations from her recent US trip and updates us on how the portfolio is positioned for the evolving investment landscape. (Viewing time: 15 mins)

A high-water mark for infrastructure investment. (Reading time: 6 mins)

Questions about the recent developments in AI. (Reading time: 5 mins)

Magellan's Nikki Thomas provides her thoughts on a handful of all-weather businesses that can generate strong returns throughout the economic cycle and companies that no longer fit that criteria. (Viewing time: 10 mins)

Global Portfolio Manager Nikki Thomas, CFA chats with Livewire Markets about Nike, Amazon, Visa and provides a stock pick which is set for strong growth over the next decade. (Listening time: 8 mins)

Magellan's Nikki Thomas shares insight into how Magellan's investment process helps filter through thousands of stocks to determine their investment universe. She also provides her high conviction stock pick. (Listening time: 7 mins)

Supporting you every minute of every day. (Reading time: 5 mins)

Diversification is an important concept that can significantly impact the success of your investment journey. While the term might sound complex, its core principle is simple and can help create a robust and resilient investment portfolio.

A Managed Fund gives investors access to a portfolio of individually selected companies in one easy transaction.

The Single Unit Fund Structure is a Magellan innovation that enables investors to access an open-ended fund, either off-market via an application form to the Responsible Entity or on-market via an online share trading platform or stockbroker account.

There are a number of different investment vehicles available in listed or exchange quoted structures either on the ASX or Cboe (formerly Chi-X).

What are quality companies and why does it matter when you are investing?

In this year's collection of investment insights on global equities and infrastructure, we share valuable insights and opportunities within the world of global investing. With all the volatility in markets at the moment we explain what we believe really matters in investing and what is noise.

Please complete the quiz below to receive your CPD hours.

Please complete the quiz below to receive your CPD hours.

Please complete the quiz below to receive your CPD hours.

Questions investors are asking about AI. (Reading time: 6 mins)

Magellan's Infrastructure Team provide a detailed update and outlook of the global infrastructure sectors and explain how investing in infrastructure can benefit your client’s portfolio in a high interest rate and inflationary world. In times when costs are rising, people still need essential services which means infrastructure stocks can perform well in this environment. (Recorded live: 2 May 2023)

A leader in innovative and sustainable infrastructure (Reading time: 4 mins)

A quality business going from strength to strength. (Reading time: 4 mins)

Head of Infrastructure, Gerald Stack looks at how the infrastructure sectors have fared over the past quarter, and addresses concerns about high inflation and provides an update on changes to the portfolio and how it is positioned. (Viewing time: 12 mins)

Global Portfolio Managers Nikki Thomas, and Arvid Streimann, discuss the unfolding interest rate cycle and the effect it's having on market sentiment and company valuations. They provide an update on the portfolio’s recent performance and its positioning for the current environment. (Viewing time: 15 mins)

Magellan's Portfolio Manager, Alan Pullen, provides a timely update on the financials sector in light of the recent volatility we've seen with banks in the US and Europe.

Quality is a frequently used term in investing, but from Magellan's experience definition really does matter. Why, because not all company fundamentals are the same. Learn more. (Viewing time: 11 mins)

Did you know Magellan offers research driven, actively managed and competitively priced funds? Watch now to learn more.

Elisa Di Marco recently joined Owen Raszkiewicz on The Australian Investors Podcast to reveal the truth about quality investing, dive deep into the payments industry and illustrate what makes companies like Visa Inc (NYSE: V) and Mastercard Inc (NYSE: MA) true global leaders. (Listening time: 58 mins)

Nearly 40 years after being released, QuickBooks and TurboTax have a long growth runway. (Reading time: 4 mins)

With great power (and scale) comes great responsibility (and opportunity). (Reading time: 4 mins)

The port in a storm: Resilience, inflation protection, and option value. (Reading time: 4 mins)

Magellan's Portfolio Managers Nikki Thomas, CFA and Arvid Streimann, CFA, discuss how they are viewing the current inflationary environment and chances of a recession. They explain how Magellan's Global Portfolio is positioned to manage these risks and take advantage of thematic investment opportunities.

(Viewing time: 15 mins)

Magellan's Deputy CIO, Head of Infrastructure and Portfolio Manager, Gerald Stack, mentions the challenges that the Infrastructure portfolio faced in 2022. Gerald describes how the portfolio is positioned now to take advantage of growth trends such as the re-opening of the global economy and the transition to renewable energy. (Viewing time: 17 mins)

Emma Henderson, Investment Analyst, sits down with Equity Mates to discuss the American quick service restaurant chain, Chipotle. Emma explains why Chipotle has favourable competitive advantages and a long runway for growth. (Listening time: 45 mins)

(Reading time: 4 mins)

David George, and Global Portfolio Managers Nikki Thomas and Arvid Streimann, explain how Magellan’s consistent and prudent approach to investing is steering them through today’s crises.

The Netherlands company, with its lithography, is behind the world’s best microchips. (Reading time: 4 mins)

Europe’s energy crisis provides an opportunity for the Italian gas infrastructure giant. As does the renewables push. (Reading time: 3 mins)

Nikki Thomas, CFA, Portfolio Manager, discusses the market's reaction to the volatile macro environment, how Magellan's Global Portfolios are positioned and which quality companies are well placed to deliver growth in the years ahead. (Viewing time: 8 mins)

Gerald Stack and Ofer Karliner, CFA, discuss the recent reporting season, the European energy crisis and provide an outlook for companies in Magellan's Infrastructure Strategy. (Viewing time: 15 mins)

China’s woes could prove to be the global economy’s biggest blow. (Reading time: 7 mins)

An overreliance on vanishing Russian fossil fuels will torment Europe. (Reading time: 6 mins)

A high US dollar exporting inflation, a shrinking US economy and struggles in emerging countries stand out as challenges. (Reading time: 6 mins)

But the clean-energy option will forever risk a catastrophe. (Reading time: 6 mins)

The Italian tollway and airport group holds such attractive assets it’s being taken private (Reading time: 3 mins)

The world’s biggest distiller benefits from people drinking better, even if they drink less. (Reading time: 4 mins)

In this year’s collection of insights from our investment team and other experts, our global portfolio managers explain why (and how) inflation, inequality, geopolitics and climate change will dominate global economies and markets in the coming 12 months – and how these forces are influencing their investment decisions now. Leon Panetta, the former US Defence Secretary, discusses why the world is at a dangerous and pivotal moment. You’ll also find our annual fund reports, quarterly fund factsheets and much more.

The last two years has seen international travel upended, domestic transport challenged, ‘essential services’ redefined and a growing interest in the role infrastructure can play in decarbonisation. With this backdrop, does the case for investing in global listed infrastructure still stack up? (Viewing time: 82 mins)

The impediments to supply are likely to last and disrupt growth and provoke inflation. (Reading time: 4 mins)

But display ads face privacy and regulatory challenges that reduce their effectiveness. (Reading time: 4 mins)

Any crunch would centre on Italy, have no obvious solution and remind that the euro’s frailties are unaddressed. (Reading time: 6 mins)

A market failure means pharmaceutical companies are failing to address the threat.

Innovation that enhances everyday brands is strengthening the Swiss giant’s moat. (Reading time: 5 mins)

His problem? Monetary policy is ill-suited to fight inflation arising from supply constraints. (Reading time: 6 mins)

This insulation from rising prices should help protect their share prices. (Reading time: 6 mins)

InvestorDaily podcast host David Stratford, is joined by Elisa Di Marco, Magellan Core ESG Fund Portfolio Manager. In this episode, Elisa explains that companies with ESG aren’t just performing lip-service for better publicity, rather, they are genuinely concerned for proper compliance to globally-proven environmental policies. Elisa also discusses the importance of engagement and management, as well as how ESG policies significantly reduce the element of risk when investing in a company of any scale. (Listening time: 26 mins)

A loss of autonomy to fight inflation is just one of the dangers. (Reading time: 5 mins)

The first one fizzled. Can asset-selling – aka money destroying – help fight inflation? (Reading time: 5 mins)

Remote work is ensconced. A ‘Great Resignation’ is underway in the US. Neither might last. (Reading time: 5 mins)

We provide an update on Magellan’s global strategy and the current macroeconomic landscape, plus a chance to hear from portfolio managers Chris Mackay, Nikki Thomas and Arvid Streimann. (Viewing time: 46 mins)

Webinar recorded: 10 February 2022

The last two years has seen international travel upended, domestic transport challenged, ‘essential services’ redefined and a growing interest in the role infrastructure can play in decarbonisation. With this backdrop, does the case for investing in global listed infrastructure still stack up?

A pioneer of digitalised financial markets that owns the New York Stock Exchange among others. (Reading time: 3 min)

Portfolio Manager Ofer Karliner, outlines why listed infrastructure and utilities stocks rallied in the fourth quarter, the likely recovery in airport assets, why high carbon scores can be a misleading guide to ESG risks for infrastructure stocks, and why, even if interest rates rise, the infrastructure portfolios still comes with diversification, inflation protection, capital growth and yield benefits if the universe is defined correctly. (Viewing time: 10 mins)

Somewhere a ceiling exists. Trouble is brewing, especially in the eurozone and emerging countries. (Reading time: 6 mins)

The US electricity and gas company’s strategy is regulated green power. (Reading time: 2 min)

The touted ‘embodied internet’ might take a while to arrive and could underwhelm, even with Big Tech support. (Reading time: 5 mins)

A cost disadvantage needs to be overcome first. (Reading time: 4 mins)

Ofer Karliner, Portfolio Manager, provides an Infrastructure update, discusses what trends he's seeing in the uptake of global travel and the risks of inflation. (Viewing time: 9 min)

Broader financial instability can’t be ruled out. (Reading time: 4 mins)

Cracking down on cryptocurrencies might ruin the risk-reward calculation for criminals. (Reading time: 5 mins)

The commercialisation of space comes with unknown promise but known risks. (Reading time: 5 mins)

A US electricity and gas utility leading the drive against climate change (and other challenges). (Reading time: 2 min)

Many think the internet giants are too big for society’s good. But even a rethink of competition policy along such lines is unlikely to curb the largest platforms. (Reading time: 4 mins)

The former deputy director of the CIA discusses the lack of a US policy on China, the threat of a war over Taiwan, Russian ransomware and the world’s biggest threat.

David Costello, Portfolio Manager, talks investing in Infrastructure with Alec & Bryce from Equity Mates. (Listening time: 51 mins)

The company’s iconic brands extend beyond the world-famous cola drink into snacks. (Reading time: 2 min)

Powering the US Midwest in a greener way. (Reading time: 2 min)

But problems need to be overcome to hasten the switch and cement the climate benefits. (Reading time: 5 min)

Is a watershed reengineering of money underway? (Reading time: 4 min)

Domestic production gets priority in a strategy that seeks to boost China's 'soft power'. (Reading time: 4 min)

But efforts to rein in the US-based CDA section 230 protections pose dilemmas that prevent watershed action. (Reading time: 4 min)

Gerald Stack dissects recent portfolio performance, potential inflation concerns and investment opportunities as global economic re-openings begin to gather pace. (Viewing time: 17 mins)

Hamish Douglass and Chris Wheldon, Portfolio Managers of Magellan's High Conviction strategy discuss the positioning and composition of the portfolio in the context of Magellan's economic outlook and offer their investment thesis for the streaming giant, Netflix. (Viewing time: 42 mins)

Enjoying a decent slice of the hugely popular and competitive streaming industry. (Reading time: 2 min)

Might his emergency stimulus revive inflation? (Reading time: 5 min)

Delivering for customers and investors rain, hail or shine. (Reading time: 2 min)

Public disgruntlement stops Berlin cementing a currency union that helps make the country an export dynamo. (Reading time: 5 min)

The campaign for dominance in semiconductors could hurt both countries. (Reading time: 5 min)

Gerald Stack dissects recent performance and changes made to the portfolios, and looks ahead to the opportunities and risks that may present themselves in 2021. (Viewing time: 27 mins)

The Spanish company that is the world’s biggest airport operator can expect a busier 2021. (Reading time: 2 min)

Will Japan under Suga try the reflationary option Abe didn’t? (Reading time: 5 min)

The Magellan GLOBAL Listed Infrastructure team lead by Gerald Stack, Magellan's Head of Investments & Infrastructure share their insights on the current state of the global listed infrastructure sector, including the recent performance, outlook, and future opportunities for investors as we move into 2021. (Viewing time: 60 mins)

Magellan's investment team take a deep dive into the tech sector and provide insights on Facebook, Tencent, Alibaba and Ant Financial IPO. (Viewing time: 47 mins)

No option removes the existential threats to the UK stirred by its EU departure. (Reading time: 6 min)

Ultra-loose monetary policy could even be counterproductive for economies. (Reading time: 5 min)

It’s one of the stocks that pop up if you google ‘world’s most valuable companies’. (Reading time: 2 min)

Powering southern and southeastern Australia with an eye on renewables. (Reading time: 2 min)

Any quest to alter the constitutional order would be more proof of how primary contests are destabilising US politics. (Reading time: 6 min)

But any rupture is likely to fall short of the separation the word implies. (Reading time: 8 min)

An electricity utility poised to seize opportunities as Spain turns to renewables. (Reading time: 3 min)

Today, airports around the world collectively cater for more than four billion passengers annually, with growth driven by the expansion of the middle class combined with the declining cost of air travel. For most investors, the listed market is the only way to gain access to the airport infrastructure that has underpinned this growth.

"In today's modern world, people are either asleep or connected." - Janice Reinold, Rosetta Marketing

Regulated utilities are known for their ability to generate predictable returns regardless of market conditions.

For this reason, we often describe utility stocks as the ‘lead in the keel’ of our infrastructure portfolios. They allow us to navigate volatile global equity markets with confidence.

We often observe generalist market commentators suggesting that the share prices for toll roads and infrastructure stocks are stretched. Analysis of these conclusions suggest that they are underpinned by crude valuation measures that fail to account for the unique characteristics of these assets. In this note, we talk about our approach to valuing toll roads and how it differs from approaches that are often applied to valuing equities.